Groupon is red hot. A recent press release says Groupon serves emails in 50 cities and has sold 4 million deals to customers. In just a couple of years, the company has skyrocketed to 230 employees and a valuation over $1 billion. Some say Groupon is cheap at $1 billion. But I’m suspicious. The typical bull argument looks at their revenues and projects growth. I don’ t think the growth is sustainable.

Key points:

- Groupon has no top notch repeat business customers

- Groupon has few exclusive deals

- Groupon is benefiting from a reversible economic trend

- Groupon’s inside investors are selling

- Groupon’s main assets are an email list and brand, which aren’t worth $1 Billion

Groupon has no top notch, repeat business customers. I was talking with a successful venture capitalist today about what he looks for when evaluating a revenue source. He said they don’t just look for companies that have had a single success with a revenue source. They like to see repeat revenue from the same buyers. This explains why I’ve heard that DailyCandy was valued at $60/subscriber — Microsoft kept buying with them, and Microsoft is a very data driven advertiser. At the early stages of proving their business model, Google had Amazon and eBay as repeat advertisers, while also getting ads from the long tail. Yet, Groupon is too new to have repeat buyers—in fact, they discourage companies from appearing often on their site. And the marquis local companies they have worked with were rarely for standard deals—you can’t build a $1 billion business helping chains like Legal Seafood with their one off events. Local businesses have expressed experiencing mixed results. Anecdotally, it feels that Groupon gets local businesses at their weakest and not the strong, new restaurants I want to try.

Many Groupon deals are not exclusive. Groupon drives people to share and act because they have limited time offers. However, you can deals similar deals to those offered via Groupon through other websites every day of the week. I hypothesize this is how they source their deals. So, Groupon is really just a filter for, like Thrillist or Woot!. These are profitable businesses, but not billion dollar businesses. They don’t have a unique way of source local advertisers. Here are some recent New York City Groupons you can replicate on most days:

Get better-than-Groupon deals at NYC restaurants

Essex and

The Elephant by following the previous links and using code “Feast”.

Groupon is playing into an economic trend. So, if Groupon doesn’t have great deals, maybe their value is their email list. And it’s an email list of people who like to share on Facebook and Twitter. But more than anything else, I think this email list is only valuable in a recession. Groupon markets themselves to businesses as popular among “young professionals”. These consumers are part of the trends saving money. For the first time in 10 years, personal income declined in 2009.

U.S. Annual Personal Income - U.S. Department of Commerce

As a result, people are more often looking for, and more socially comfortable using, coupons. Multiple sources say that for 17 years coupon usage was flat or declining, and just saw an uptick in 2009. The new investors want Groupon to exit for greater than $1 billion in 1 to 3 years, which is not going to be possible if coupon interest and revenues fall off in different economic circumstances.

Groupon has insider investors selling. It’s being reported that some of Groupon’s early investors sold a portion of their stock in the company [Update: insider sales may exceed $160 million]. I understand that the founder wants to diversify his holdings, but I’m surprised that investors are taking money out of the company. If these insider investors have a track record of being right about when to sell, watch out.

So, Groupon has built a valuable email list and is appreciated for it’s editorial voice (they do some funny stunts). Starts have aligned to give them one-time wins in a time of economic fear among small businesses and consumers. But this business is not delivering returns to late investors.

What do you think? Is Groupon easily worth more than $1 billion?

Did you like this? Share it:

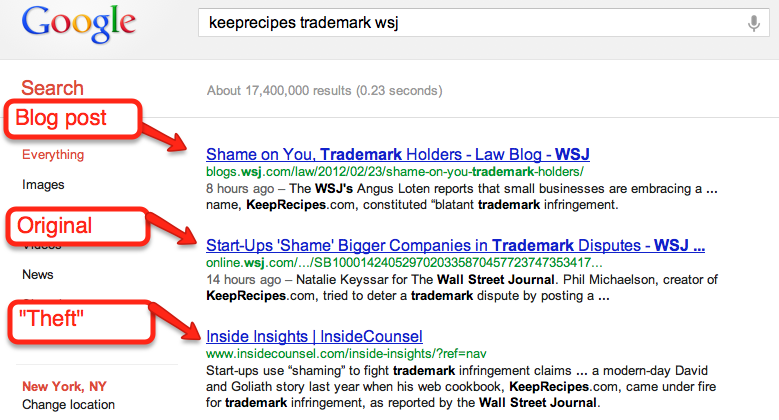

Google search results now show up to 4 articles from the same domain. So, the publisher can aim for all 4, or at least the top 2, which get the overwhelming majority of clicks.

Google search results now show up to 4 articles from the same domain. So, the publisher can aim for all 4, or at least the top 2, which get the overwhelming majority of clicks.